Definition of whole life death insurance

Its name is frequently unclear. Whole life death insurance, often known as lifetime death insurance, is not a savings product, in contrast to life insurance. Taken out with the intention of providing provident insurance, it ensures the transfer of a capital or an annuity to one or more beneficiaries of the contracting party’s choosing upon death. In exchange, the insured makes recurrent payments (or premiums) to his insurer over the course of his lifetime.

Why get entire life insurance against death?

Those close to you may also suffer financially if you pass away unexpectedly. funeral costs, regular costs (rent, mortgage, etc.), education costs for children… Your partner might not be able to manage home finances on their own. By purchasing whole life death insurance, you can predetermine the amount of money that will be paid to your loved ones, allowing them to meet immediate needs, maintain their current standard of living over the long term, or even cover future needs (such as children’s education, etc.) depending on the amount. This kind of agreement is adaptable.

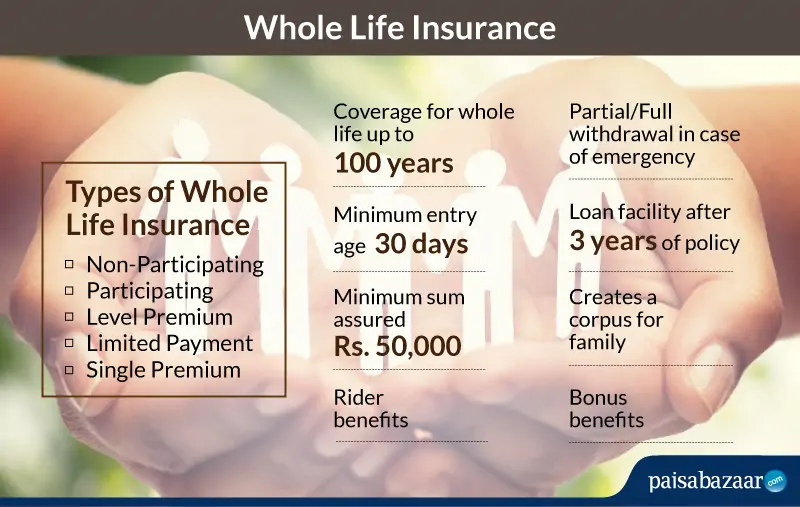

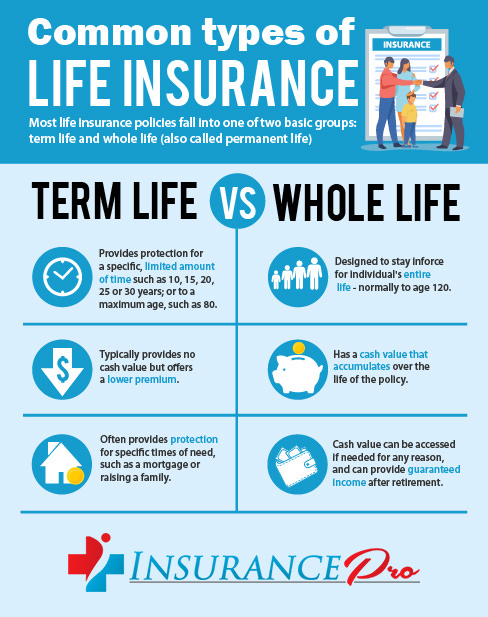

What time frame is the coverage?

This contract protects the insured for the duration of his life, as the name implies. The capital consequently passes to the chosen beneficiary(ies), regardless of the date of its disappearance. In this regard, it varies from term life insurance, the guarantee of which is only applicable in the case of death prior to the expiration of the contract.

How much will be contributed?

The premiums are not placed in “lost funds” contrary to the temporary death guarantee because the insurer is guaranteed to pay the benefits as the contract will not be fulfilled until the insured’s death. Therefore, their amount is greater. However, because the beneficiaries of whole life death insurance are assured to receive the stipulated amount, regardless of the seniority of the contract and, therefore, the value of the collected contributions, this kind of insurance continues to be highly advantageous to the subscriber and his or her family. A contract may exclude some promises (such as those related to suicide, participation in dangerous sports, making false statements about one’s condition of health, etc.). In this scenario, only the made contributions will be reimbursed; the capital will not be compensated.

What additional assurances?

Additional guarantees may be included in certain terms, such as a capital increase of two or three times (depending on the circumstances of the death, such as a car accident), benefits in the case of entire or partial disability, and payment of contributions in the event of inability to work.